Fascination About Fortitude Financial Group

Table of ContentsSee This Report about Fortitude Financial GroupGetting The Fortitude Financial Group To WorkThe Best Guide To Fortitude Financial GroupSome Known Details About Fortitude Financial Group The Best Strategy To Use For Fortitude Financial Group

In a nutshell, a financial expert assists people handle their money. Some economic advisors, often accounting professionals or lawyers that specialize in counts on and estates, are wealth supervisors.And afterwards there are economic consultants who concentrate on monetary planning. Typically, their focus is on educating clients and providing danger management, capital analysis, retired life preparation, education preparation, investing and a lot more. To discover an economic expert that offers your area, try using SmartAsset's cost-free matching device. Unlike attorneys who need to go to legislation institution and pass the bar or physicians that need to go to medical institution and pass their boards, economic experts have no specific special needs.

Generally, though, a financial consultant will have some sort of training. If it's not with a scholastic program, it's from apprenticing at a monetary consultatory company (Financial Services in St. Petersburg, FL). Individuals at a company who are still finding out the ropes are often called partners or they're component of the administrative team. As kept in mind previously, though, several experts come from other fields.

Or perhaps someone that manages possessions for a financial investment company determines they would certainly rather assist individuals and work with the retail side of business. Many monetary advisors, whether they currently have professional levels or not, undergo certification programs for even more training. A total economic advisor certification is the qualified economic planner (CFP), while an innovative version is the chartered financial specialist (ChFC).

All about Fortitude Financial Group

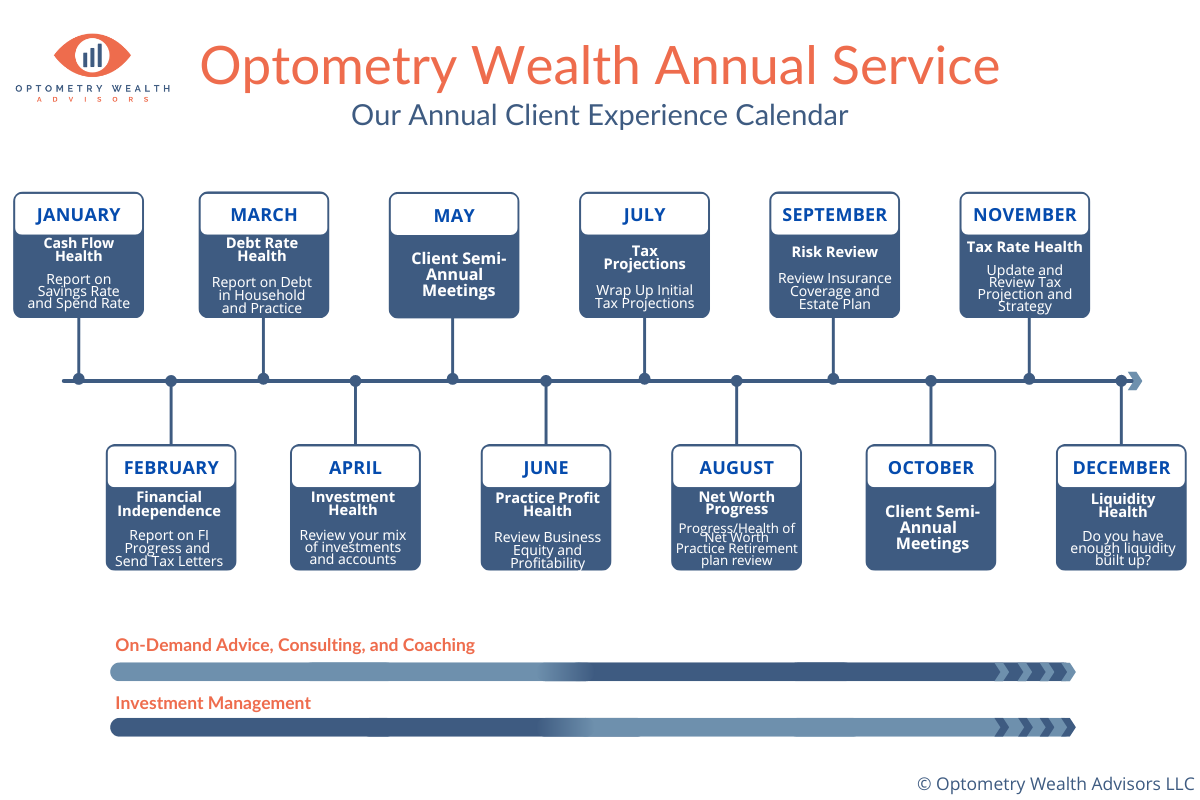

Normally, an economic advisor supplies financial investment monitoring, economic preparation or wealth monitoring. Investment monitoring includes designing your investment technique, executing it, monitoring your portfolio and rebalancing it when required. This can be on an optional basis, which suggests the consultant has the authority to make professions without your authorization. Or it can be done on a non-discretionary basis through which you'll need to authorize off on specific trades and choices.

It will detail a series of actions to take to accomplish your monetary goals, including a financial investment strategy that you can execute on your own or if you want the consultant's help, you can either employ them to do it as soon as or enroll in recurring management. Investment Planners in St. Petersburg, Florida. Or if you have specific demands, you can hire the advisor for economic preparation on a project basis

Our Fortitude Financial Group Diaries

This suggests they must place their clients' finest passions before their own, to name a few things. Other monetary consultants are members of FINRA. This has a tendency to suggest that they are brokers that additionally offer investment suggestions. Rather than a fiduciary requirement, they need to follow by Guideline Benefit, an SEC rule that was implemented in 2019.

Their names frequently state all of it: Stocks licenses, on the other hand, are much more regarding the sales side of investing. Financial consultants that are also brokers or insurance coverage representatives tend to have safety and securities licenses. If they directly buy or sell supplies, bonds, insurance coverage items or give financial advice, they'll require specific licenses connected to those items.

One of the most popular safeties sales licenses consist of Series 6 and Collection 7 classifications (https://www.gaiaonline.com/profiles/fortitudefg1/46809441/). A Series 6 permit enables a financial advisor to sell investment products such as shared funds, variable annuities, device financial investment trust funds (UITs) and some insurance products. The Collection 7 license, or General Stocks certificate (GS), permits a consultant to market most sorts of safety and securities, like typical and favored stocks, bonds, alternatives, packaged financial investment items and even more.

The Fortitude Financial Group Statements

Always ensure to ask regarding monetary advisors' charge routines. To find this details on your own, go to the firm's Type ADV that it files with the SEC.Generally talking, there are two kinds of pay structures: fee-only and fee-based. A fee-only consultant's single form of compensation is via client-paid costs.

, it's essential to understand there are a variety of settlement techniques they may use. (AUM) for managing your cash.

Based upon the aforementioned Advisory HQ study, prices normally vary from $120 to $300 per hour, commonly with a cap to just how much you'll pay in overall. Financial experts can make money with a repaired fee-for-service model. If you want a fundamental financial strategy, you could pay a level charge to get one, with the Advisory HQ research study showing typical rates varying from $7,500 to $55,000, relying on your asset tier.

Fortitude Financial Group Things To Know Before You Get This

When a consultant, such as a broker-dealer, markets you a financial product, she or he obtains a certain percent of the sale quantity. Some monetary professionals that help big brokerage firm companies, such as Charles Schwab or Integrity, receive an income from their employer. Whether you need an economic expert or not depends upon exactly how much you have in possessions.